Archive for January 22, 2021

Trading Double Tops And Double Bottoms

January 22, 2021This pattern’s highs can be placed at the same level or in growing order. The three mountains pattern is formed much less frequently on candlestick charts. The double top pattern indicates a bearish reversal and warns traders about a possible trend reversal down at the top.

Following the stop-loss and profit target criteria described above, you can place a short trade once the neckline is broken when the indicators confirm the bearish signal. First, you can wait for the price to cross below the neckline, which would confirm the double top pattern and perhaps signal a trend reversal. You can start a short trade or sell position after the break happens. To reduce risk, think about placing a stop-loss order above the most recent swing high. You can also project the vertical distance between the neckline and the highest peak downward from the neckline to determine your profit target.

Sometimes called an “M” formation because of the pattern it

creates on the chart, the double top is one of the most frequently seen and common of the patterns. Because they seem to be so easy to identify, the double top should be approached with caution

by the investor. Bulkowski estimates the double top has a failure rate of 65%.3 If an investor waits for the breakout, however, the failure rate declines to 17%. Retail traders use this price pattern to forecast a change of trend from bullish into a bearish trend. While an accuracy estimate will depend on the market traded, double-top patterns are among the more reliable chart patterns traders can use. They are easily identified and give a very bearish signal with a clear target that tends to be closely approached in many cases.

Analysts pay close attention to the “size” of the pattern – the duration of the

interval between the two tops. Generally, the longer the time between the two tops, the more important the pattern as a good reversal. Analysts suggest that investors should look for patterns

where at least one month elapses between the peaks. It is not unusual for a few months to pass between the dates of the two tops. A double top pattern forms in the zone of high prices and looks like the letter M.

Double Tops Forex Strategy: A Step-by-Step Guide to Profitable Trading

As the stock approaches the prior high volume surges and new buyers begin to talk about bright

fundamental prospects. It is at that moment that all of the investors who purchased positions at the prior high begin selling. On the chart two equal peaks are

created, the double top is in place. In many cases double top formations lead to important declines because two separate sets of investors have been disappointed at a particular

level. Double Top formation is a distinct chart pattern characterized by a rally to a new

high followed by a moderate pullback and a second rally to test the new high.

Double Top Pattern: A Forex Trader’s Guide – DailyFX

Double Top Pattern: A Forex Trader’s Guide.

Posted: Fri, 28 Jun 2019 07:00:00 GMT [source]

You could also use a “trailing stop-loss” that adjusts as the price goes down, locking in your gains. To trade a double top, first, spot the pattern where the price goes up twice but can’t break above the highest point. Then, put in an order to sell when the price drops below the lowest point between the two highs – that’s called the neckline. Volume tends to be heaviest during the first peak, lighter on the second.

Step 9: Stop Loss

By constantly incorporating volatility, they adjust quickly to the rhythm of the market. Using them to set proper stops when trading double bottoms and double tops—the most frequent price patterns in FX—makes those common trades much more effective. Leaving the trade early may seem prudent and logical, but markets are rarely that straightforward. The net effect is a series of frustrating stops out of positions that often would have turned out to be successful trades.

Similarly, the double bottom pattern reciprocates the double top pattern signaling a bullish reversal. Instead of the confirmation being shown at a break in the key support level, the double bottom double top pattern forex strategy occurs at the key resistance highs between the two low points. The double top and double bottom patterns are powerful technical tools used by traders in major financial markets including forex.

The 5%ers Funding Forex Traders & Growth Program – Copyright © 2023

Remember, just like double tops, double bottoms are also trend reversal formations. A double top is a very bearish pattern that signals a strong market decline will likely take place once its neckline breaks to the downside. The trough defines the level of this classic chart pattern’s neckline. A sustained break of that neckline level sets up a measured move equal to the vertical distance between the neckline and the double peak.

This time we have added a second arrow which is equivalent to the first arrow. So, the first arrow measures the size of the pattern and the second arrow applies this size as a minimum target of the pattern. The first thing you need to do when you spot the pattern is to manually add the Neck Line on the chart. Next, we’re going to show you in greater detail how to successfully trade the double bottom pattern in our next strategy guide. You’ll see the double top breakout happen over and over again, but it’s important to analyze them within the context of the market trend. You need to identify two rounded tops in order for the double top breakout to be considered tradable.

- The profit target is determined by the distance from the tops to the neckline, that is, traders can immediately determine the further movement.

- This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

- It signals the end of a long rally and that buyers cannot push prices higher above a certain resistance level.

- The conventional wisdom says that once the pattern is broken, the trader should get out.

- You should measure the size of the pattern as discussed earlier and then apply it downwards starting from the Neck Line.

- The market then returned to support and retested the resistance level (second top) but was rejected again.

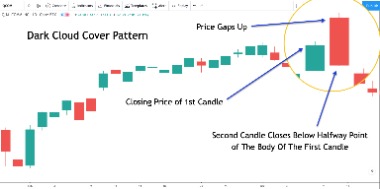

Forex double top pattern looks like the formation of two maxima at a critical resistance level. A double top in Forex implies that the market would likely stop at this level the third time if it has already deviated from it twice. However, some other important aspects must be considered for a template to be handy. The double top pattern is a bearish reversal trading pattern that emerges at the end of a bullish trend. Sometimes the price breaks through the neckline and continues to rise.

The Role of Central Banks in Euro USD Forex Trading

These patterns are often used in conjunction with other indicators since rounding patterns in general can easily lead to fakeouts or mistaking reversal trends. Fortunately in FX where many dealers allow flexible lot sizes, down to one unit per lot—the 2% rule of thumb is easily possible. Nevertheless, many traders insist on using tight stops on highly leveraged positions. In fact, it is quite common for a trader to generate 10 consecutive losing trades under such tight stop methods. So, we could say that in FX, instead of controlling risk, ineffective stops might even increase it.

- It is also essential to confirm the chart pattern with other aspects of technical analysis.

- Fortunately in FX where many dealers allow flexible lot sizes, down to one unit per lot—the 2% rule of thumb is easily possible.

- Notice that after the break through the Neck line, the price action creates a big bullish correction as a result of high volatility.

- In the next example using Netflix Inc. (NFLX), we can see what appears to be the formation of a double top.

Take note that in the two examples we discussed, the trend line breakout appeared at different times in the process. In the first case the price broke the trend after the creation of the second top. In the second case the trend breakout came right after the creation of the first bottom. In both cases the patterns were valid and led to a price move equal to the size of the pattern.

Double Top Chart Pattern Forex Trading Strategy

Both of these patterns suggest that the asset is in a trend reversal, as price action fails to break through either the resistance or support level after two attempts. Forex traders typically look for signals such as trend line breaks and momentum indicators to confirm this reversal before entering into trades. The double top pattern is formed after a prior uptrend with the first peak reaching a resistance high in conjunction with an overbought signal highlighted by the RSI oscillator.

What is Forex Price Action Trading? – Benzinga

What is Forex Price Action Trading?.

Posted: Mon, 26 Jun 2023 07:00:00 GMT [source]

As the stock rallies to make the second peak (top) sellers overwhelm buyers and the stock price collapses. Several weeks later the stock moves to test prior support levels. You can use double tops or double bottoms to trade forex when you create an account with us. If you identify a double top pattern, you could open a short position after the second https://g-markets.net/ peak, and with a double bottom, you could open a long position after the second low. It’s crucial to remember that chart patterns, like the double top pattern, don’t always accurately forecast future price alterations. They can produce false signals or unsuccessful patterns, but they are useful for spotting possible trends and reversals.

Plus, there’s usually often a definite resistance level that is formed when two peaks at roughly the same price level appear consecutively. This level can be used by traders as a benchmark for establishing stop-loss orders and profit objectives, improving risk management and trade planning. In conclusion, double top patterns are valuable tools for forex traders to identify potential reversals in an uptrend. By understanding the characteristics of this pattern and applying appropriate trading strategies, traders can increase their chances of success.